Buying a new home is a significant milestone, yet it can also become overwhelming, especially when it comes to planning your budget. That’s where I step in. As an expert agent with Century 21, I’m here to help you navigate this crucial process.

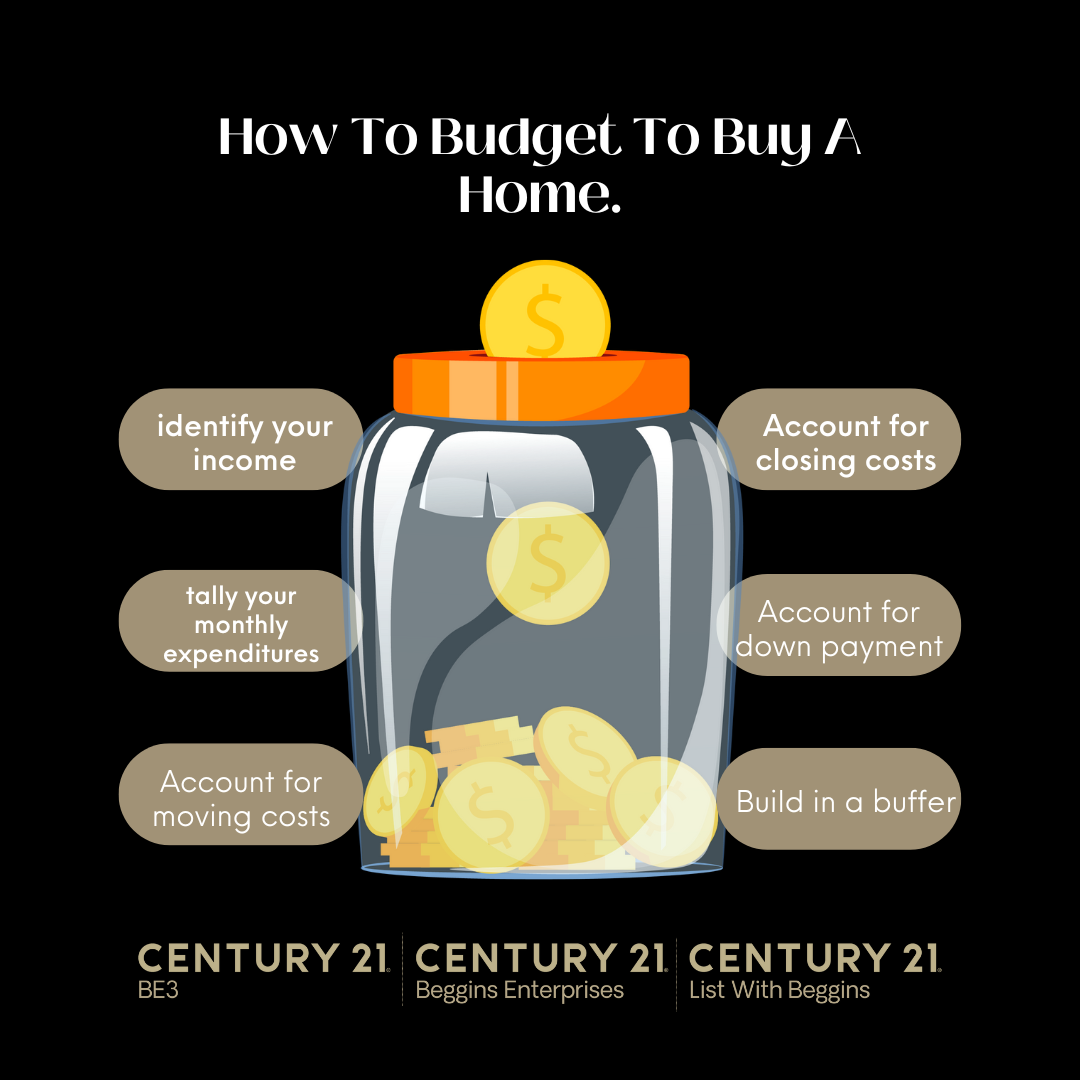

Creating a budget for a new home involves several key factors, and I’m here to guide you through each step. Let’s break down the essentials:

1. Identify Your Income: We’ll start by assessing your income, including your salary, bonuses, and any other sources of income. Understanding your financial capacity is the foundation of your budget.

2. Tally Your Monthly Expenditures: It’s essential to have a clear picture of your current monthly expenses. This includes everything from rent and utilities to groceries and entertainment. We’ll make sure your new home budget aligns with your lifestyle.

3. Consider All Potential Costs: Home-buying involves more than just the purchase price. We’ll factor in expenses like home inspections, closing costs, and moving expenses. By considering all costs upfront, we can avoid surprises down the road.

4. Build in a Buffer: Life is unpredictable, and unexpected expenses can arise. That’s why we’ll build a buffer into your budget to ensure you have financial security in case of emergencies or unforeseen costs.

At Century 21, we do more than just facilitate buying and selling. We empower you with the knowledge and strategies needed to turn a house into your dream home while ensuring it’s a successful investment for you and your family.

Feel free to reply to this email or call me directly at [Your contact number]. Let’s begin planning your smart home-buying budget together. Whether you’re a first-time homebuyer or looking to upgrade, I’m here to guide you on this exciting journey toward homeownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link